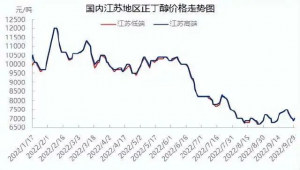

Butyl octanol market prices fell significantly this year. The price of n-butanol broke through 10000 yuan/ton at the beginning of the year, dropped to less than 7000 yuan/ton at the end of September, and dropped to about 30% (it has basically fallen to the cost line). Gross profit also dropped to 125 yuan/ton. It seems that the market that should be golden nine and silver ten has not arrived on time.

Butanol octanol, as its name implies, is made from butanol and octanol. Through co production, capacity can be switched between them. Therefore, the price linkage of butanol and octanol is also strong. They once shared a common fate. Butyl octanol is also often used to prepare dispersants, dehydrators and plasticizers. The main reason for its price decline is that the demand this year is relatively sluggish.

With the continuous decline of the butanol octanol market, the theoretical profit of the butanol octanol industry continues to compress, and the profit of butanol octanol fell to a negative value in mid August. Although the profits of butanol and octanol turned into profits in the middle and late August, they were still at the historical low profit level.

Butyl octanol profit from 2021-2022

The demand of downstream factories will be the leading factor determining the domestic butyl octanol market trend. Downstream of n-butanol are mainly butyl acrylate (about 60% of n-butanol consumption), butyl acetate (about 20% of n-butanol consumption) and DBP (about 15% of n-butanol consumption). Plasticizer products are mainly used in the downstream of octanol: DOTP (octanol consumption is about 55%/DOP (octanol consumption is about 30%), some environment-friendly plasticizers (octanol consumption is about 10%) and a small amount of isooctyl acrylate (octanol consumption is about 5%).

Acrylate and butyl acetate terminals downstream of n-butanol are mainly used in coating, adhesive and other construction related industries. At present, the construction industry has been greatly impacted by the epidemic. The bankruptcy and reorganization of old construction enterprises have greatly reduced the demand for n-butanol, resulting in a continuous decline in domestic n-butanol consumption.

The downstream plasticizer terminals of octanol mainly involve direct consumer industries such as leather and shoes. Affected by insufficient terminal consumption demand, the demand for octanol continues to decline. The government has introduced some policies to promote consumption, gradually promoting the slow recovery of the market, but there is no obvious change in the short term.

To sum up, given the weak overall demand of downstream plasticizer and end product markets, it is difficult to fundamentally reverse the situation, and it is expected that butanol and octanol profits will remain low and volatile.

Chemwin is a chemical raw material trading company in China, located in Shanghai Pudong New Area, with a network of ports, terminals, airports and railroad transportation, and with chemical and hazardous chemical warehouses in Shanghai, Guangzhou, Jiangyin, Dalian and Ningbo Zhoushan, China, storing more than 50,000 tons of chemical raw materials all year round, with sufficient supply, welcome to purchase and inquire. chemwin email: service@skychemwin.com whatsapp: 19117288062 Tel: +86 4008620777 +86 19117288062

Post time: Oct-11-2022