The domestic butyl acetate market has entered the high-cost era from 2021 onwards. For end customers, it is inevitable to avoid high-priced raw materials and adopt inexpensive alternatives. Thus sec-butyl acetate, propyl acetate, propylene glycol methyl ether, dimethyl carbonate, etc. all impact the butyl acetate market. The terminal side selects substitution based on the performance of different types of products, which has led to a significant decline in demand for butyl acetate in the past two years. domestic consumption of butyl acetate declined to 400,000 tons in 2021, down to the level of the 2016 timeframe. Although there is the influence of the epidemic factor, it is more due to the high cost and high price resulting in the reduction of butyl acetate in end use.

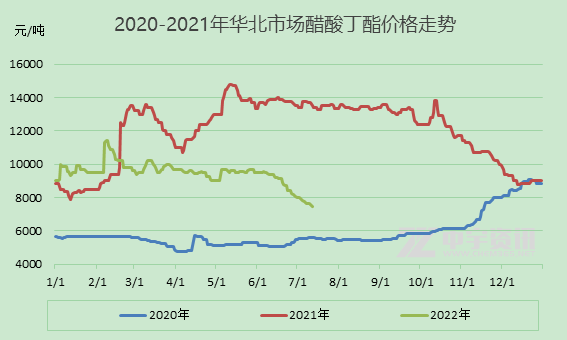

In the first half of 2022, the domestic butyl acetate market as a whole shuddered downward, and as of July 13, the mainstream market price in North China was 7,400-7450 yuan/ton, with the middle market price called a 19.29% decline at the end of last year. Chemical easy world chemical raw material procurement and sales platform, providing acetic acid, n-butanol, butyl acetate raw materials sales.

First quarter: market trading is light and prices are falling

In January, the overall trend of butyl acetate followed the rise of raw materials n-butanol, and then near the Spring Festival led to logistics restrictions, market transactions decreased.

In February, prices started to rise after the market opened after the Chinese New Year, the raw material end n-butanol because some buyers actively replenish their positions after the festival, spot scarcity, and most of the stockholders pity to sell, so the price surged again across the board.

In early March, driven by crude oil prices, methanol prices rose rapidly, acetic acid prices rose sharply, and n-butanol prices were firm, supported by the cost, butyl acetate prices followed the rise, in the middle of the month due to the epidemic, downstream demand and traffic disruptions in many places, market trading is light, the market transaction prices continue to decline.

Second quarter: the overall trend of narrow oscillation

Before the May Day holiday, downstream replenishment, and some acetic acid manufacturers have maintenance plans, acetic acid prices rose, the cost of support, butyl acetate prices followed the rise.

In June, n-butanol prices continued to soften, coupled with the continuous decline in raw material acetic acid prices, under the influence of insufficient cost support, butyl acetate prices continued to follow the decline.

In July, the price of butyl acetate continues to be weak, raw material acetic acid and n-butanol trend is weak, the cost support is insufficient, and the overall downstream demand is relatively light, the purchase of more to maintain just demand, the field trading atmosphere is general, the raw material side is expected to weaken, while the demand side of the downstream to maintain just demand, the field mentality is general, the impact of weak supply and demand, it is expected that the short-term domestic butyl acetate market or continue to be weak, the late still need to pay attention to the dynamics of the manufacturers device It is expected that the domestic butyl acetate market will remain weak in the short term.

Chemwin is a chemical raw material trading company in China, located in Shanghai Pudong New Area, with a network of ports, terminals, airports and railroad transportation, and with chemical and hazardous chemical warehouses in Shanghai, Guangzhou, Jiangyin, Dalian and Ningbo Zhoushan, China, storing more than 50,000 tons of chemical raw materials all year round, with sufficient supply, welcome to purchase and inquire. chemwin email: service@skychemwin.com whatsapp: 19117288062 Tel: +86 4008620777 +86 19117288062

Post time: Jul-14-2022