Since the end of June, the price of styrene has continued to rise by nearly 940 yuan/ton, changing the continuous decline in the second quarter, forcing industry insiders who are short selling styrene to reduce their positions. Will supply growth fall below expectations again in August? Whether the demand for Jinjiu can be released in advance is the main reason for determining whether the price of styrene can continue to be strong.

There are three main reasons for the increase in styrene prices in July: firstly, the sustained rise in international oil prices has led to an improvement in macroeconomic sentiment; Secondly, the supply growth is lower than expected, resulting in a decrease in styrene production, delayed restart of maintenance equipment, and unplanned shutdown of production equipment; Thirdly, the demand for unplanned exports has increased.

International oil prices continue to rise, and macroeconomic sentiment improves

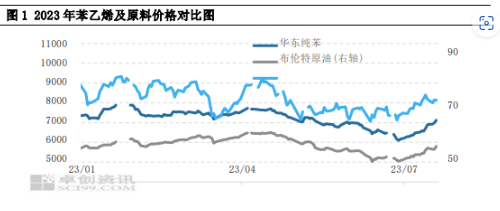

In July of this year, international oil prices began to rise, with a significant increase in the first ten days and then fluctuating at high levels. The reasons for the increase in international oil prices include: 1. Saudi Arabia voluntarily extended its production reduction and sent a signal to the market to stabilize the oil market; 2. The US inflation data CPI is lower than market expectations, leading to a weak US dollar. Market expectations for the Federal Reserve to raise interest rates this year have decreased, and it is expected to continue raising interest rates in July, but may pause in September. Against the backdrop of slowing interest rate hikes and a weak US dollar, risk appetite in the commodity market has rebounded, and crude oil continues to rise. The rise in international oil prices has driven up the price of pure benzene. Although the rise in styrene prices in July was not driven by pure benzene, it did not drag down the rise in styrene prices. From Figure 1, it can be seen that the upward trend of pure benzene is not as good as that of styrene, and the profit of styrene continues to improve.

In addition, the macro atmosphere has also changed this month, with the upcoming release of relevant documents to promote consumption boosting market sentiment. The market is expected to have relevant policies at the Economic Conference of the Central Politburo in July, and the operation is cautious.

The growth of styrene supply is lower than expected, and port inventory has decreased instead of increasing

When the supply and demand balance for July is predicted in June, it is expected that the domestic production in July will be around 1.38 million tons, and the cumulative social inventory will be around 50000 tons. However, unplanned changes resulted in a lower than expected increase in styrene production, and instead of an increase in main port inventory, it decreased.

1. Affected by objective factors, the prices of blending materials related to toluene and xylene have rapidly increased, especially alkylated oil and mixed aromatic hydrocarbons, which have promoted the increase in domestic demand for blending of toluene and xylene, resulting in a strong increase in prices. Therefore, the price of ethylbenzene has correspondingly increased. For styrene production enterprises, the production efficiency of ethylbenzene without dehydrogenation is better than the dehydrogenation yield of styrene, resulting in a decrease in styrene production. It is understood that the cost of dehydrogenation is approximately 400-500 yuan/ton. When the price difference between styrene and ethylbenzene is greater than 400-500 yuan/ton, the production of styrene is better, and vice versa. In July, due to a decrease in ethylbenzene production, the production of styrene was approximately 80-90000 tons, which is also one reason why the main port inventory did not increase.

2. The maintenance of styrene units is relatively concentrated from May to June. The original plan was to restart in July, with most of it concentrated in mid July. However, due to some objective reasons, most devices are delayed in restarting; The driving load of the new device is lower than expected, and the load remains at a medium to low level. In addition, styrene plants such as Tianjin Dagu and Hainan Refining and Chemical also have unplanned shutdowns, causing losses to domestic production.

Overseas equipment shuts down, leading to an increase in China's planned export demand for styrene

In the middle of this month, the styrene plant in the United States was planned to cease operation, while the maintenance of the plant in Europe was planned. Prices rapidly increased, the arbitrage window opened, and the demand for arbitrage increased. Traders actively participated in negotiations, and there were already export transactions. In the past two weeks, the total export transaction volume has been around 29000 tons, mostly installed in August, mostly in South Korea. Although Chinese goods were not directly delivered to Europe, after logistics optimization, the deployment of goods indirectly filled the gap in European direction, and attention was paid to whether transactions could continue in the future. At present, it is understood that the production of devices in the United States will be discontinued or will return in late July and early August, while approximately 2 million tons of devices in Europe will be discontinued in the later stages. If they continue to import from China, they can largely offset the growth in domestic production.

The downstream situation is not optimistic, but it has not reached a negative feedback level

At present, in addition to focusing on exports, the market industry also believes that negative feedback from downstream demand is the key to determining the top price of styrene. The three key factors in determining whether downstream negative feedback affects enterprise shutdown/load reduction are: 1. whether downstream profits are at a loss; 2. Are there any orders downstream; 3. Is the downstream inventory high. At present, downstream EPS/PS profits have lost money, but the losses in the past two years are still acceptable, and the ABS industry still has profits. At present, PS inventory is at a low level and orders are still acceptable; EPS inventory growth is slow, with some companies having higher inventory and weaker orders. In summary, although the downstream situation is not optimistic, it has not yet reached the level of negative feedback.

It is understood that some terminals still have good expectations for Double Eleven and Double Twelve, and the production scheduling plan for home appliance factories in September is expected to increase. Therefore, there are still strong prices under the expected replenishment in late August. There are two situations:

1. If styrene rebounds before mid August, there is an expectation of a rebound in prices by the end of the month;

2. If styrene does not rebound before mid August and continues to strengthen, terminal restocking may be delayed, and prices may weaken at the end of the month.

Post time: Jul-25-2023