In the first half of 2022, octanol showed a trend of rising before moving sideways and then falling, with prices declining significantly year-on-year. In the Jiangsu market, for example, the market price was RMB10,650/tonne at the beginning of the year and RMB8,950/tonne at mid-year, with an average price of RMB12,331/tonne, down 10.8% year-on-year. The highest price in the first half of the year was RMB14,500/tonne, which occurred in early February. The lowest price was RMB8,950 per tonne, occurring in late June, with an amplitude of RMB5,550 per tonne between high and low points.

Octanol price fluctuations in the first half of the year were characterised by complexity and diversity. The first quarter saw a relatively strong trend in the octanol market, but the overall performance of the domestic market was less than expected as demand for downstream products, led by PVC medical gloves, declined. The second quarter coincided with the traditional peak demand season, but the impact of transport restrictions around the Yangtze River Delta, the impact of the peak demand season was significantly weakened, although at this time, the domestic multi-set of devices focused on maintenance, barely on octanol to form the bottom support. The second half of the second quarter, dragged down by the collective decline in domestic chemicals, overlaid with the supply of octanol industry back up, the expected decline dragged octanol back down quickly.

The factors behind the price change matched the supply and demand data for octanol to a greater extent.

Monthly output of octanol in the first half of 2022 was elevated on a YoY basis. Total domestic octanol production in the first half of the year was 1,722,500 tonnes, an increase of 7.33% year-on-year. The largest month of production occurred in March at 220,900 tonnes; the smallest month of production occurred in June at 20,400 tonnes. During the first half of the year, the high profitability of the octanol industry stimulated companies to maintain a high willingness to produce, and at one point attracted some n-butanol capacity to switch to octanol production. After the second quarter, domestic plant maintenance activities increased and octanol production declined.

Imports are also an important part of octanol supply, with imports of octanol declining significantly from January to May on a chain basis. 2022 China’s imports of octanol from January to May were 69,200 tonnes, down 29.2% on the same period last year. During the period, the import arbitrage window opened poorly, another domestic market performance is more sluggish, octanol imports of goods fell significantly.

From the supply side of the data, the supply of octanol during the first half of the year appeared significantly higher, but the downstream demand performance is less than expected. From the first half of the main downstream of octanol DOTP and DOP production data, DOP production increased by 12% year-on-year to 550,000 tons, DOTP production fell 2% year-on-year to 700,000 tons. In the face of a significant increase in the supply side, demand growth is less than expected to trigger an oversupply of octanol, and triggered the industry continued to accumulate storage. Against the backdrop of high inventories, octanol saw a broad retreat as downstream orders contracted in May-June.

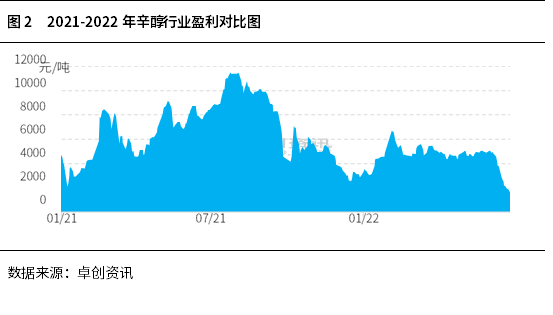

During the first half of the year, the high output of the octanol industry was closely related to the reduction in planned maintenance of the plant, in addition to the better profit level, which was another key factor in the year-on-year increase in octanol output. 2022 The average gross profit of octanol in Shandong in the first half of the year was RMB 4,625 per tonne, down 25.8% year-on-year. The maximum value of profit was RMB6,746/tonne, which occurred in early February. The lowest value was RMB1,901/t, which occurred in late June.

During the first half of the year, although most market players had high expectations for octanol, the rapid accumulation of stocks in the octanol-plasticizer industry chain after the second quarter, against the backdrop of shrinking total demand year-on-year and another record high domestic production, eventually induced a rapid decline in octanol.

Chemwin is a chemical raw material trading company in China, located in Shanghai Pudong New Area, with a network of ports, terminals, airports and railroad transportation, and with chemical and hazardous chemical warehouses in Shanghai, Guangzhou, Jiangyin, Dalian and Ningbo Zhoushan, China, storing more than 50,000 tons of chemical raw materials all year round, with sufficient supply, welcome to purchase and inquire. chemwin email: service@skychemwin.com whatsapp: 19117288062 Tel: +86 4008620777 +86 19117288062

Post time: Sep-06-2022