Since mid November, the Chinese isopropanol market has experienced a rebound. The 100000 ton/isopropanol plant in the main factory has been operating under reduced load, which has stimulated the market. In addition, due to the previous decline, intermediaries and downstream inventory were at a low level. Encouraged by new news, buyers were buying on dips, resulting in a temporary shortage of isopropanol supply. Subsequently, export news emerged and orders increased, further supporting the rise in isopropanol prices. As of November 17, 2023, the market price of isopropanol in Jiangsu Province is set at 8000-8200 yuan/ton, an increase of 7.28% compared to November 10.

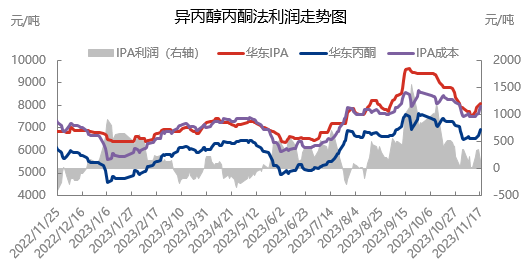

1、 Strong cost support for acetone isopropanol process

During the cycle, the raw material acetone increased significantly, with the reference price of acetone in Jiangsu as of November 17th at 7950 yuan/ton, an increase of 6.51% compared to November 10th. Correspondingly, the cost value of isopropanol increased to 7950 yuan/ton, a month on month increase of 5.65%. It is expected that the rise of the acetone market will slow down in the short term. Insufficient arrival of imported goods at the port has led to a decrease in port inventory, and domestic goods have been arranged according to plan. Holders have limited spot resources, resulting in strong price support sentiment and insufficient interest in shipping. The offer is firm and upward. Terminal factories have gradually entered the market to replenish goods, expanding transaction volume.

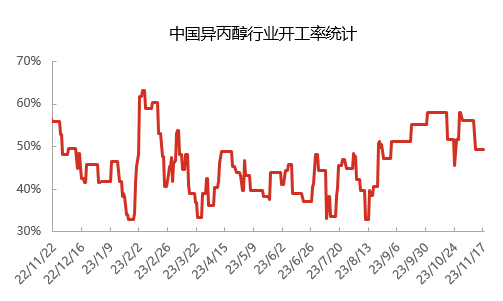

2、 The operating rate of the isopropanol industry has decreased, and spot supply has decreased

On November 17th, the average operating rate of the isopropanol industry in China was about 49%. Among them, the operating rate of acetone based isopropanol enterprises is about 50%, while Lihua Yiwei Yuan’s 100000 ton/year isopropanol plant has reduced its load, and Huizhou Yuxin’s 50000 ton/year isopropanol production has also reduced its production load. The operating rate of propylene isopropanol enterprises is about 47%. With the gradual depletion of factory inventory and the high enthusiasm for downstream buying, some companies have already fulfilled their order displacement plans, and their external lending is limited. Despite a decrease in replenishment enthusiasm, companies are still mainly focused on delivering orders in the short term, and inventory remains low.

3、 Market mentality is optimistic

Picture

According to the survey results of market participants’ mentality, 30% of businesses are bearish towards the future market. They believe that the current downstream acceptance of high prices is decreasing, and the phased replenishment cycle is basically over, and the demand side will weaken. At the same time, 38% of homeowners are bullish on the future market. They believe that there is still a possibility of a tentative increase in the raw material acetone, with strong cost support. In addition, some companies that have lowered their burden have not yet heard of plans to increase their burden, and supply remains tight. With the support of export orders, subsequent positive news still exists.

In summary, although downstream buying enthusiasm has decreased and some homeowners have insufficient confidence in the future, it is expected that factory inventory will remain low in the short term. The company will mainly deliver preliminary orders and has heard that there are export orders under negotiation. This may have a certain supportive effect on the market, and it is expected that the isopropanol market will remain strong in the short term. However, considering the possibility of weak demand and cost pressures, the future growth of the isopropanol industry may be limited.

Post time: Nov-21-2023