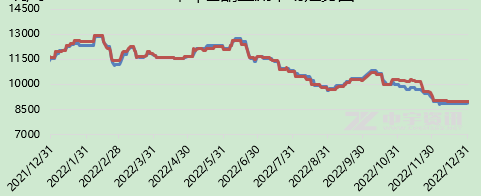

The domestic market price of cyclohexanone fell in the high fluctuation in 2022, showing a pattern of high before and low after. As of December 31, taking the delivery price in the East China market as an example, the overall price range was 8800-8900 yuan/ton, down 2700 yuan/ton or 23.38% from 11500-11600 yuan/ton in the same period last year; The annual low price was 8700 yuan/ton, the high price was 12900 yuan/ton, and the annual average price was 11022.48 yuan/ton, a year-on-year decrease of 3.68%. Specifically, the cyclohexanone market fluctuated greatly in the first half of the year. In the first quarter of 2022, the price of cyclohexanone rose as a whole and then settled at a high level. Due to the rise of pure benzene, the cost support is stable. In addition, the cyclohexanone equipment supporting its own lactam enterprises in the downstream is abnormal. The products are prepared before the Spring Festival, and chemical fibers are intensively replenished. The overall cyclohexanone market is on the high side. After the Spring Festival, under the guidance of international crude oil, the raw material pure benzene continued to rebound, the downstream products of pure benzene were boosted, and the industrial chain conducted well. In addition, the supply of cyclohexanone has decreased, the market has risen sharply, and there are also intraday rises and falls. In March, the market gradually encountered resistance, with the rise and fall of crude oil. “Gold, silver and fourth” caused by the epidemic “missed the traditional demand. In the short term, the contradiction between the” stable output “of upstream cyclohexanone and caprolactam and the” weak demand “of terminal textiles will become the main theme. In May, with the control of the epidemic situation and the repair of terminal demand, the profit level of the industrial chain has improved. Under the favorable factors of phased release of demand and high impact of pure benzene, the cyclohexanone market hit a peak of 12750 yuan/ton in the year.

In the second half of the year, the cyclohexanone market continued to decline. In June August, the spot price of raw material pure benzene fell sharply. In the first half of the year, due to the rapid growth of new downstream production capacity of pure benzene and the favorable support of the decline of international crude oil and pure benzene port inventory, the price of pure benzene rose all the way. However, in the second half of the year, affected by the high decline of international crude oil and downstream demand and commencement, the arrival of pure benzene in East China increased. The pure benzene market is no longer rising, and the price drops rapidly. At the same time, the downstream demand of cyclohexanone is weak. Due to sufficient supply, the cyclohexanone market has been falling all the way, which is difficult to boost. With the decline of prices, corporate profits continued to decline. Yangmei Fengxi, Shandong Haili, Jiangsu Haili, Luxi Oxidation Unit, Jining Bank of China and other commodity volume units stopped production or reduced production. The overall operating load of commodity volume was less than 50%, and the supply gradually decreased. In terms of demand, caprolactam is in sufficient supply, the product has suffered long-term losses, and the overall operating load is as low as about 65%. Inner Mongolia Qinghua, Heze Xuyang, Hubei Sanning, Zhejiang Juhua caprolactam parking, Nanjing Dongfang, Baling Petrochemical, Tianchen and other equipment are not satisfied with the start of construction, and the downstream paint, paint, pharmaceutical intermediates and other solvent markets are also in the off-season. The demand for downstream chemical fiber and solvent is poor. Only some cyclohexanone oxidation equipment costs more, and a small amount of cyclohexanone is still difficult to boost the market price of cyclohexanone. At the end of August, the price in East China fell to 9650 yuan/ton.

In September, the cyclohexanone market gradually stabilized and rose, mainly due to the rise of the pure benzene raw material market. The cost is well supported. The downstream self amide rises steadily, and chemical fiber only needs to follow up. The low price of cyclohexanone fell and the transaction focus rose, driven by the positive situation. In addition, the demand for replenishment before the National Day supported the rise of the market focus. After the National Day holiday, it continued to rise. Due to the general rise in overseas markets, the prices of crude oil and pure benzene rose. Supported by the cost, the price of cyclohexanone gradually rose to 10850 yuan/ton. However, as the positive gradually subsided, energy prices fell, domestic and local epidemics rebounded, market demand declined, and the market fell back.

It is estimated that in 2023, with the optimization of domestic epidemic policy and the good expectation of macro-economy, the market demand for cyclohexanone is expected to rise. However, in recent two years, there have been many new production capacity, and a large number of new equipment will be put into production in the future, and many supporting caprolactam projects will be put into production. The trend of cyclohexanone caprolactam slice integration is becoming more and more obvious. In terms of cost, without strong profits to promote or maintain a volatile trend in international crude oil, pure benzene is still difficult to rebound, and the cost of cyclohexanone is generally supported; In addition, the excess pressure of downstream amide industry will gradually appear, and the price competition pressure of cyclohexanone market will continue to increase, and will be limited by the long-term loss of the industry.

Post time: Jan-09-2023