The acrylonitrile industry ushered in a capacity release cycle in 2022, with capacity growing at more than 10% year-on-year and increasing supply pressure. At the same time, we see that the demand side is not as good as it should be due to the epidemic, and the industry is dominated by the downtrend, with bright spots hard to find.

Data source: Goldlink

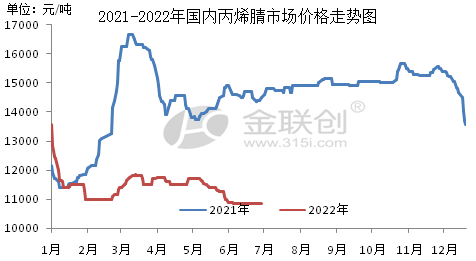

The domestic acrylonitrile market in the first half of 2022 showed a first decline followed by a wide range of oscillation dominated. Taking the East China market as an example, the average price in the first half of 2022 was at RMB 11,455/ton, down 21.29% year-on-year, with the highest price of RMB 13,100/ton, which occurred in January, and the lowest point of RMB 10,800/ton, which occurred in June.

The main factors affecting the market are.

I. Supply increase. 2022 is still a year of concentrated domestic acrylonitrile expansion, putting into operation 2 sets of acrylonitrile plants with a total capacity of 390,000 tons/year, including Lihua Yi 260,000 tons/year and Tianchen Qixiang 130,000 tons/year. Although the export volume rose 12.1% year-on-year from January to May, the supply and demand still tended to develop loosely.

Second, the recurrence of the epidemic led to increased pressure on factory inventories. Since entering 2022 it has always been in the stage of oversupply, enterprises and social inventory accelerated accumulation after the impact of the outbreak opened at the end of the first quarter, logistics in East China and Shandong basically stopped, and there was also a large area of downstream reduction and shutdown, after the weakening of demand, acrylonitrile factory inventory pressure has been increasing, has continued to reduce the price promotion policy.

Third, the downstream industry demand growth is limited. 150,000 tons/year of new LG Huizhou plant was added to ABS in the first half of 2022, using only 37,500 tons/year of raw materials acrylonitrile, so the growth of downstream capacity is less than the growth of raw materials, so the average opening of acrylonitrile plants in the first half of the year is near 80%, which shows that the plant sales pressure.

In the second half of 2022, China’s acrylonitrile market will continue its low-level oscillation trend, and the overall adjustment space is relatively limited. In addition, acrylonitrile new production capacity increased significantly in the second half of the year, and the amount of supplied commodities may continue to rise. However, downstream only ABS is expected to have new devices put into operation, the overall demand is limited, under the mismatch between supply and demand, acrylonitrile supply and demand contradictions will continue to increase, when the factory opening is also difficult to enhance, larger capacity enterprises will purchase negative measures. Since acrylonitrile is mostly under the cost line, it is still necessary to pay attention to the trend of raw material propylene. Ex-factory prices (market prices) are expected to be in the range of RMB 10,000-12,000/mt in the main regions, with the high point probably occurring in August.

In China’s acrylonitrile market in the second half of 2022, feedstock propylene is the main influencing factor for price fluctuations. Since the significant expansion of production capacity in the second half of the year is a foregone conclusion, it is difficult to have a significant price rebound opportunity in the second half. Therefore, the price of raw material propylene will be the key factor to determine the price of acrylonitrile. If propylene stays near RMB 8,000/mt, it will be difficult for acrylonitrile to continue to fall. However, if propylene price continues to fall, acrylonitrile price will still have the possibility to decline under the pressure of oversupply.

From 2022 to 2023, China will add 1.38 million tons/year of acrylonitrile plants, and many of them are refining and chemical integrated supporting devices, which are more likely to be put into operation. However, downstream only ABS is developing fast, like acrylics and acrylamide are in a lukewarm state, which will inevitably form an oversupply situation. It is expected that in the next three years, with the expansion of acrylonitrile capacity, industry profits decline, and some of the new installations are facing the possibility of delays and shelving.

Chemwin is a chemical raw material trading company in China, located in Shanghai Pudong New Area, with port, wharf, airport and railway transportation network, and in Shanghai, Guangzhou, Jiangyin, Dalian and Ningbo Zhoushan in China, with chemical and dangerous chemical warehouses, with a year-round storage capacity of more than 50,000 tons of chemical raw materials, with sufficient supply of goods.chemwin E-mail: service@skychemwin.com whatsapp:19117288062 Phone:+86 4008620777 +86 19117288062

Post time: Jun-29-2022