In the third quarter, the supply and demand of acrylonitrile market was weak, the factory cost pressure was obvious, and the market price rebounded after falling. It is expected that the downstream demand of acrylonitrile will increase in the fourth quarter, but its own capacity will continue to expand, and the Acrylonitrile price may remain low.

Acrylonitrile prices rebounded after falling in the third quarter

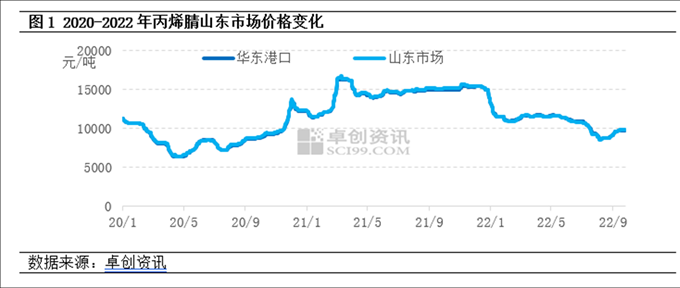

The third quarter of 2022 rose after the decline in the third quarter of 022. In the third quarter, the supply and demand of acrylonitrile gradually decreased, but the factory cost pressure was obvious. After the manufacturer’s maintenance and burden reduction operations increased, the price mentality was significantly enhanced. After the expansion of 390000 tons of acrylonitrile in the first half of this year, the downstream only expanded 750000 tons of ABS energy, and the consumption of acrylonitrile increased by less than 200000 tons. In the context of loose supply in the acrylonitrile industry, the market transaction focus decreased slightly compared with the second quarter. As of September 26, the average price of Shandong acrylonitrile market in the third quarter was 9443 yuan/ton, down 16.5% month on month.

Supply side: In the first half of this year, Lihua Yijin refined 260000 tons of oil, and Tianchen Qixiang’s new capacity was 130000 tons. Downstream demand growth was lower than supply. Since February of this year, acrylonitrile plants have continued to lose money, and enthusiasm of some manufacturers has declined. In the third quarter, many sets of acrylonitrile units were repaired in Jiangsu Silbang, Shandong Kruer, Jilin Petrochemical, and Tianchen Qixiang, and the industry output fell sharply month on month.

Demand side: ABS’s profitability has weakened significantly, even lost money in July, and the enthusiasm of manufacturers to start construction has decreased significantly; In August, there was a lot of hot weather in summer, and the starting load of acrylamide plant decreased slightly; In September, Northeast Acrylic Fiber Factory was overhauled, and the industry started to operate less than 30%

Cost: the average price of propylene as the main raw material and synthetic ammonia decreased by 11.8% and 25.1% respectively

Acrylonitrile prices may remain low in the fourth quarter

Supply side: In the fourth quarter, several sets of acrylonitrile units are expected to be stored and put into production, including 260000 tons of Liaoning Jinfa, 130000 tons of Jihua (Jieyang) and 200000 tons of CNOOC Dongfang Petrochemical. At present, the operating load rate of the acrylonitrile industry has dropped to a relatively low level, and it is difficult to significantly reduce the operating load in the fourth quarter. Acrylonitrile supply is expected to increase.

Demand side: ABS capacity in the downstream is expanding intensively, with an estimated new capacity of 2.6 million tons; In addition, the new capacity of 200000 tons of butadiene acrylonitrile latex is expected to be put into production, and the demand for acrylonitrile is expected to increase, but the demand increase is less than the supply increase, and the basic support is relatively limited.

On the cost side: the prices of propylene and synthetic ammonia, the main raw materials, are expected to fall after rising, and the average prices in the third quarter may not have much difference. The acrylonitrile factory continued to lose money, and the cost still supported the price of acrylonitrile.

At present, the acrylonitrile market is facing the problem of overcapacity. Despite the double growth of supply and demand in the fourth quarter, the growth of demand is expected to be lower than that of supply. The situation of loose supply in the acrylonitrile industry continues, and the pressure on cost still exists. The acrylonitrile market in the fourth quarter will have no obvious optimistic expectation, and the price may remain low.

Post time: Sep-28-2022