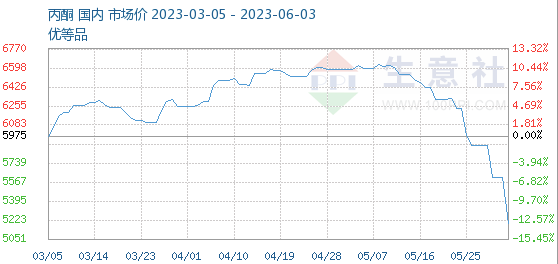

On June 3rd, the benchmark price of acetone was 5195.00 yuan/ton, a decrease of -7.44% compared to the beginning of this month (5612.50 yuan/ton).

With the continuous decline of the acetone market, terminal factories at the beginning of the month were mainly focused on digesting contracts, and proactive procurement was insufficient, making it difficult to release short-term actual orders.

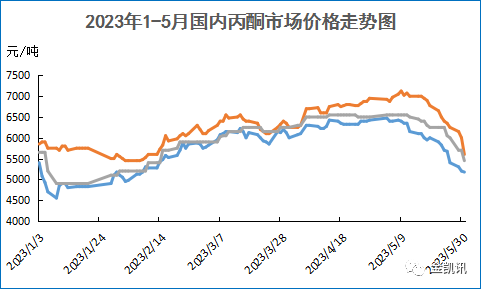

In May, the price of acetone in the domestic market went down all the way. As of May 31, the average monthly price in the East China market was 5965 yuan tons, down 5.46% month on month. Despite concentrated maintenance of phenolic ketone plants and low port inventory, which remained around 25000 tons, the overall supply of acetone in May remained low, but downstream demand continued to be sluggish.

Bisphenol A: The production capacity utilization rate of domestic devices is around 70%. Cangzhou Dahua operates around 60% of its 200000 ton/year plant; Shandong Luxi Chemical’s 200000 ton/year plant shutdown; The 120000 ton/year unit of Sinopec Sanjing in Shanghai was shut down for maintenance on May 19th due to steam issues in the park, with an expected maintenance period of about 10 days; The load of Guangxi Huayi Bisphenol A Plant has slightly increased.

MMA: The capacity utilization rate of the acetone cyanohydrin MMA unit is 47.5%. Some units in Jiangsu Silbang, Zhejiang Petrochemical Phase I unit, and Lihua Yilijin refining unit have not yet resumed restarting. The Mitsubishi Chemical Raw Materials (Shanghai) unit was shut down for maintenance this week, resulting in a decrease in the overall operating load of MMA.

Isopropanol: The operating rate of domestic acetone based isopropanol enterprises is 41%, and Kailing Chemical’s 100000 ton/year plant is shut down; Shandong Dadi’s 100000 ton/year installation will be parked at the end of April; The 50000 ton/year installation of Dezhou Detian will be parked on May 2nd; Hailijia’s 50000 ton/year plant operates at low load; Lihuayi’s 100000 ton/year isopropanol plant operates under reduced load.

MIBK: The industry’s operating rate is 46%. Jilin Petrochemical’s 15000 ton/year MIBK device was shut down on May 4th, but the restart time is uncertain. Ningbo’s 5000 ton/year MIBK device was shut down for maintenance on May 16th, and resumed restart this week, gradually increasing the burden.

Weak downstream demand makes it difficult for acetone market to ship. In addition, the upstream raw material market continues to decline, and the cost side also lacks support, so the price of acetone market continues to fall.

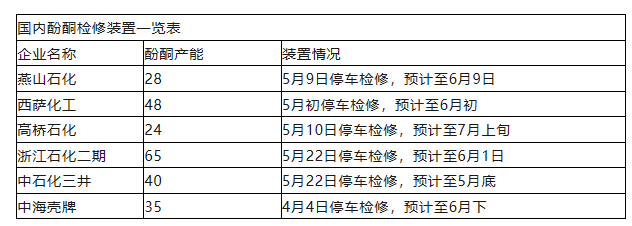

List of Domestic Phenol Ketone Maintenance Devices

Parking for maintenance on April 4th, expected to end in June

From the above list of device maintenance, it can be seen that some phenolic ketone maintenance devices are about to restart, and the operating load of acetone enterprises is increasing. In addition, 320000 tons of phenolic ketone devices in Qingdao Bay and 450000 tons of phenolic ketone devices in Huizhou Zhongxin Phase II are planned to be put into operation from June to July, with clear market supply increments and downstream demand entering the off-season, and the supply and demand links are still under pressure.

It is expected that there will still be little improvement in the market this week, and there is inevitably a risk of further decline. We need to wait for the release of demand signals.

Post time: Jun-05-2023