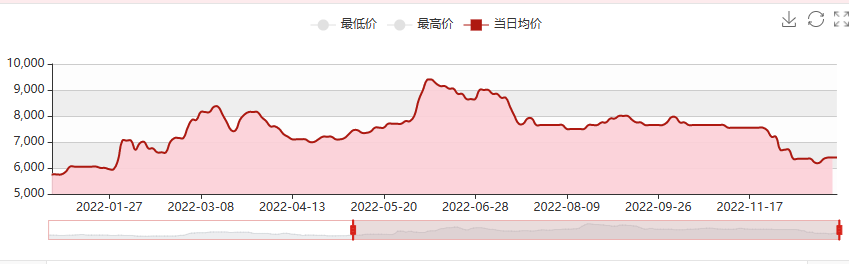

In 2022, the domestic toluene market, driven by cost pressure and strong domestic and foreign demand, showed a broad rise in market prices, hitting the highest level in nearly a decade, and further promoted the rapid increase of toluene exports, becoming a normalization. In the year, toluene became a product with high market heat; The price fell in the second half of the year, but it was larger than the trend of related products and regional differences. Toluene inventory shows a cumulative trend, which has little impact on the market price in the short term, but in the long term, it may limit the market price increase and increase the operational risk.

Summary of domestic toluene market

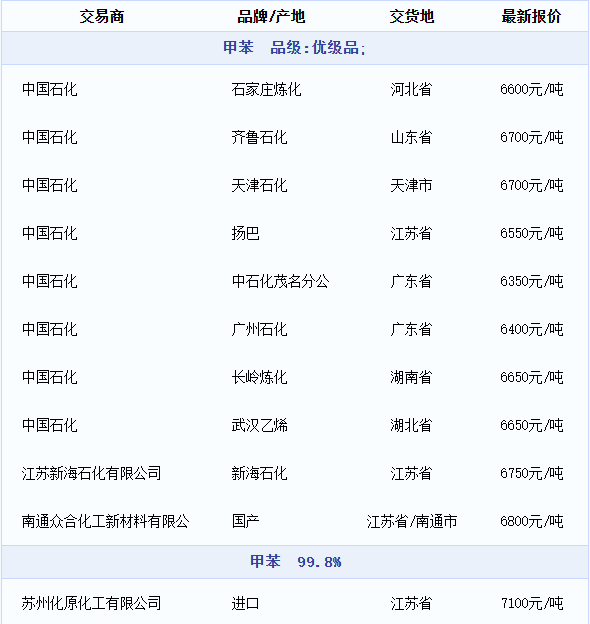

In 2022, domestic toluene will operate at a high level, and the highest transaction price of toluene will be 9620 yuan/ton, which is the highest price since March 2013. At the same time, the crude oil price rose by more than 50%, providing effective support to the cost side. The annual average price was 7610.51 yuan/ton, up 32.48% year on year; The lowest point of the year was 5705 yuan/ton in January at the beginning of the year, and the highest point was 9620 yuan/ton in the middle of June. At present, due to the sluggish growth of the gasoline industry, the resistance of the raw material market to keep up with the growth is relatively large, and there are only a few companies. Many downstream industries are closed for holidays, so the atmosphere of toluene is relatively quiet, and the trend of the gasoline industry is waiting. Up to now, Sinopec Chemical Sales North China Branch has listed the price of toluene in January, with Tianjin Petrochemical and Qilu Petrochemical implementing 6500 yuan/ton and Shijiazhuang Refinery implementing 6400 yuan/ton. East China Branch listed the price of toluene in January, and Shanghai Petrochemical, Jinling Petrochemical, Yangzi BASF and Zhenhai Refining&Chemical implemented 6550 yuan/ton of spot exchange. The listing price of toluene in South China Branch in January was 6400 yuan/ton for Guangzhou Petrochemical, 6350 yuan/ton for Maoming

Petrochemical and Zhongke Refining and Chemical.

Toluene market quotation

South China: the toluene/xylene negotiation in South China has stabilized, and the narrow fluctuation of intraday oil price has given the bottom support. Some main enterprises have reported low shipments of toluene, and traders have made up for bargains. The trading volume is positive, and the transaction is fair; The xylene spot is tight, and the terminal factories are gradually delisted, and the trading volume is weak. The closing price of toluene is 6250-6500 yuan/ton, and the closing price of isomeric xylene is 6750-6950 yuan/ton.

East China: the toluene/xylene negotiation in South China has stabilized, and the narrow fluctuation of intraday oil price has given the bottom support. Some main enterprises have reported low shipments of toluene, and traders have bargained for replenishment. The trading volume is positive, and the transaction is fair; The xylene spot is tight, and the terminal factories are gradually delisted, and the trading volume is weak. The closing price of toluene is 6250-6500 yuan/ton, and the closing price of isomeric xylene is 6750-6950 yuan/ton.

Analysis of toluene supply and demand

Cost side: US crude oil fell for two consecutive days at the end of the week, but there was support because the inventory was still at a low level, so it was less likely to fall below the support level of US $70/barrel.

On the supply side: In 2022, the toluene inventory in the main port of Jiangsu showed a trend of constant and repeated fluctuations, which was mainly affected by the periodic export of the port in Jiangsu. However, on the whole, the inventory in the main port of Jiangsu remained at the low level in the year after August, but by the end of the year and the beginning of the 23, the inventory in the main port of Jiangsu rose to 60000 tons, higher than the average level in 2022, and the inventory rose to the relatively high level in recent years. After the new year, the sales pressure of enterprises has weakened, but in order to ensure stable production during the Spring Festival, it still maintains a stable delivery rhythm.

Demand side: As the Spring Festival approaches, the number of people’s cars and trips is expected to increase, and the demand for fuel transfer is supported. The next cycle is the last cycle for the terminal factory to prepare goods, and the terminal just needs to be supported. The price of toluene may fluctuate against the background of relatively stable supply and demand.

The possibility of strong turbulence in the future market of toluene is high

It is expected that the domestic toluene market will stabilize and fluctuate in the short term. 2023 will be a year to sharpen the momentum. The economic situation in foreign countries is not optimistic. It is difficult to replicate the situation that the market price is rapidly rising in the peak travel season in the United States. Therefore, it is not likely that the domestic market price will rise again to this year’s high in 2023. However, the transportation problem has gradually improved, and the domestic oil transfer demand is expected to recover gradually in 2023. The total demand has gradually increased with the centralized production of downstream production capacity. In general, it is expected that the price fluctuation range of domestic toluene market will narrow in 2023, and the possibility of strong shocks is high.

Chemwin is a chemical raw material trading company in China, located in Shanghai Pudong New Area, with a network of ports, terminals, airports and railroad transportation, and with chemical and hazardous chemical warehouses in Shanghai, Guangzhou, Jiangyin, Dalian and Ningbo Zhoushan, China, storing more than 50,000 tons of chemical raw materials all year round, with sufficient supply, welcome to purchase and inquire. chemwin email: service@skychemwin.com whatsapp: 19117288062 Tel: +86 4008620777 +86 19117288062

Post time: Jan-13-2023