In recent five years, China’s MMA market has been in the stage of high capacity growth, and the oversupply has gradually become prominent. The obvious feature of 2022MMA market is capacity expansion, with capacity increasing by 38.24% year on year, while the output growth is limited by insufficient demand, with a year-on-year growth of only 1.13%. With the growth of domestic production capacity, imports are expected to continue to shrink in 2022. Although exports shrank at the same time, the domestic contradiction between supply and demand still existed, which still existed in the later period. The MMA industry urgently needs more export opportunities.

As a connecting intermediate chemical product, MMA is constantly improving its integrated supporting facilities from the perspective of product life cycle. At present, the industry has entered a mature stage and needs to be optimized to improve the imbalance between supply and demand in the market. In 2022, the product industry chain will attract much attention.

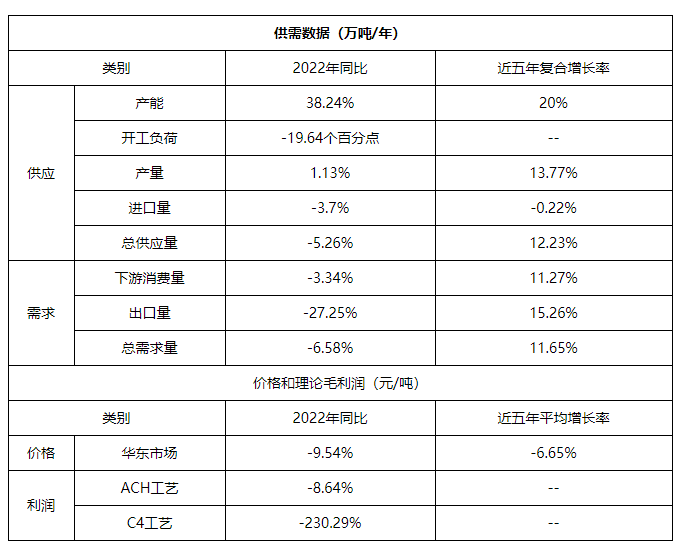

Picture of China’s MMA Annual Data Change in 2022

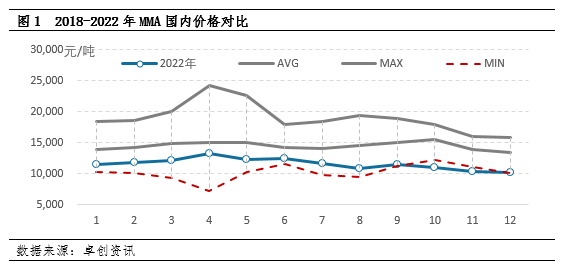

1. The price of MMA in the year has been operating below the average in the same period of the last five years.

In 2022, the price of the whole MMA product will operate below the average of the same period in the past five years. In 2022, the annual average price of the primary market in East China will be 11595 yuan/ton, down 9.54% year on year. The centralized release of industrial capacity and insufficient follow-up of secondary terminal demand are the main factors driving the low price operation. Especially in the fourth quarter, due to the increase of supply and demand pressure, the MMA market was in a downward channel, and the low-end price fell below the lowest negotiation level before August. Towards the end of the year, the market negotiation price was lower than the lowest level in the same period of the last five years.

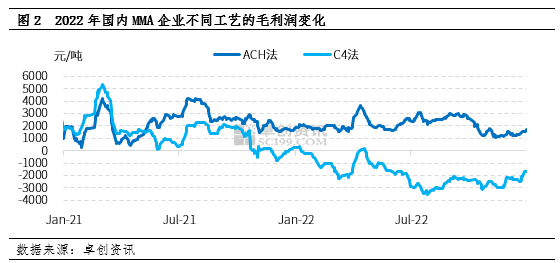

2. Gross profits of different processes are all in deficit. Year on year decrease of 9.54% by ACH method

In 2022, the theoretical gross profit of enterprises with different processes of MMA will vary greatly. The legal gross profit of ACH will be about 2071 yuan per ton, a decrease of 9.54% over the same period last year. The gross profit of C4 method was – 1901 yuan/ton, down 230% year on year. The main factors causing the decrease of gross profit: on the one hand, the price of MMA in the year showed an average offline fluctuation in the past five years; on the other hand, in the fourth quarter, as the supply and demand pressure of MMA market increased, the price of MMA market continued to fall, while the price of raw material acetone fell by a limited margin, leading to the narrowing of enterprise profits.

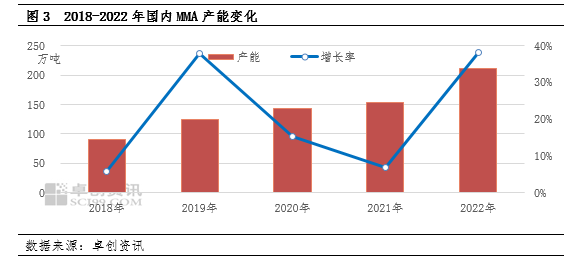

3. MMA capacity growth rate increased by 38.24% year-on-year

In 2022, the domestic MMA capacity will reach 2.115 million tons, with a year-on-year growth of 38.24%. According to the change of absolute value of production capacity, the net capacity increase in 2022 will be 585000 tons, which will be completed and put into operation, totaling 585000 tons, including Zhejiang Petrochemical Phase II, Silbang Phase III, Lihuayi, Jiangsu Jiankun, Wanhua, Hongxu, etc. As far as the process is concerned, due to the rapid development of domestic acrylonitrile ABS industry in 2022, many sets of new units of ACH process MMA in domestic industry were launched in 2022, and the proportion of ACH process was increased to 72%.

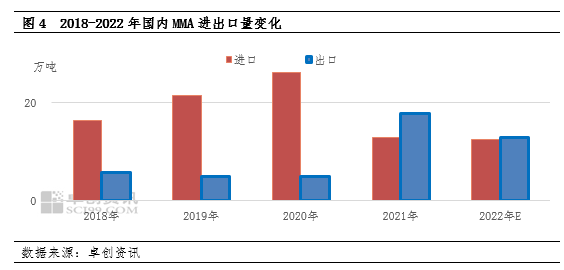

4. The import, export and export of MMA decreased by more than 27% year on year.

In 2022, MMA expects that the export volume will drop to 130000 tons, a year-on-year drop of about 27.25%. The reason for the sharp drop in export volume is that the foreign supply gap and the price trade surplus have declined year on year, combined with the impact of the global economic environment. It is estimated that the import volume will drop to 125000 tons, down 3.7% year on year. The main reason for the decline in domestic imports is that the MMA production capacity has entered the expansion period, the rising trend of domestic supply has no advantage over the foreign market, and the trading interest of importers has declined.

Compared with 2022, the capacity growth of MMA in 2023 is expected to be 24.35%, which is expected to slow down by nearly 14 percentage points. The capacity release in 2023 will be allocated in the first quarter and the fourth quarter, which are expected to be restrained to some extent. The role of MMA price. Although the downstream industry also has the expectation of capacity expansion, it is expected that the supply growth rate will be slightly higher than the demand growth rate, and the overall market price may have the expectation of downward adjustment. However, with the development of relevant industrial chains, the industrial structure will continue to be adjusted and deepened.

Chemwin is a chemical raw material trading company in China, located in Shanghai Pudong New Area, with a network of ports, terminals, airports and railroad transportation, and with chemical and hazardous chemical warehouses in Shanghai, Guangzhou, Jiangyin, Dalian and Ningbo Zhoushan, China, storing more than 50,000 tons of chemical raw materials all year round, with sufficient supply, welcome to purchase and inquire. chemwin email: service@skychemwin.com whatsapp: 19117288062 Tel: +86 4008620777 +86 19117288062

Post time: Jan-05-2023